How To Get GST Invoice From Flipkart

🕐 1 Jul 23

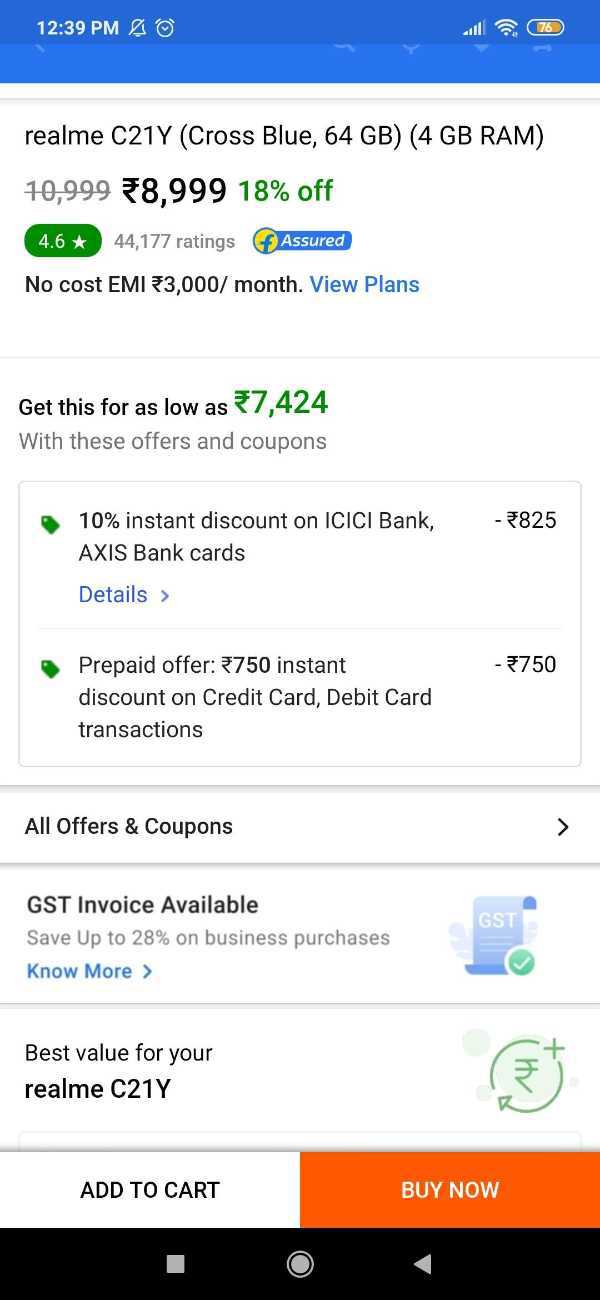

In this article we will show you how to get GST invoice from Flipkart, Flipkart recently had included an option to get the for various products. Flipkart doesn't provide a GST invoice for its product. But Amazon used to provide a GST invoice.

GST invoice is provided through the Amazon business account.

Any business owner who is registered along with a GST number can enjoy this benefit. It is really helpful as earlier only two platforms were offering this feature. The benefits offered by Amazon and Paytm were limited.

In Flipkart you can get the benefit of various products at once during checkout. In Amazon first you need to have a business account which will not provide a direct benefit of the sale and also the price range is distinct for users.

A GST invoice is a feature available for selective products in which you need to enter your GST details after placing the order. You can get a GST invoice at the time of checkout which is essential to put tags input credit.

In order to get the GST invoice, the GST state code must match your registered delivery address. There are certain services levied on the products which are not eligible for GST invoice such as

- Complete mobile protection

- Exchange offers

- Assured buy back and others

Step By Step Guide On How To Get GST Invoice From Flipkart :-

- Open the application in your smartphone and login by entering your password and email ID. in case you do not have a Flipkart application, you need to install it from your Play Store.

- Open the product page you wish to buy.

-

Look for the seller detail section. in this section you will get to know if the seller provide GST invoice for that particular product.

- Now you need to add the product to cart if the seller offers the GST invoice.

-

Go to the order summary option, here you will see the option of use GST invoice. click that option.

- Now you need to enter your business name and GSTIN.

-

Press confirm and save.

- Before making any payment check your GST details and the product you wish to purchase.

- Now you can move forward with the payment for the product you wish to buy.

Terms And Conditions While Getting GST :-

- Check for the availability of the GST for the particular product you wish to purchase.

- The GST number address and delivery address must match.

- The GST number address and delivery address provided must be registered.

- GST is not applicable on the value-added services.

- GST is not applicable if it is purchased using an exchange offer.

Conclusion :-

In this article we covered an essential guide on how to get a GST invoice from Flipkart.

The article also covers the terms and conditions while availing GST and the certain services which are not eligible to claim GST. I hope this article on how to get GST invoice from Flipkart helps you